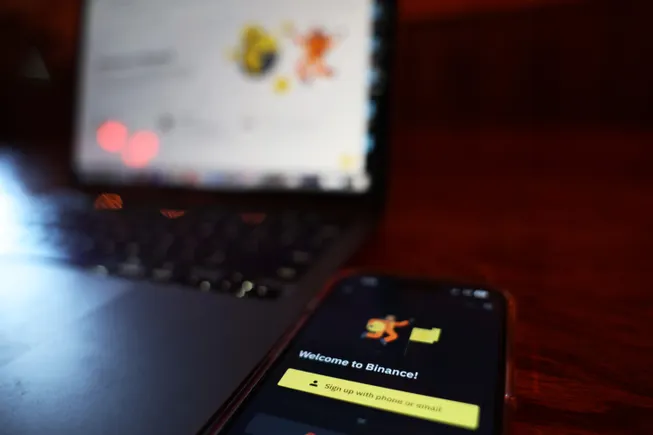

The Securities and Exchange Commission (SEC) formally dropped its lawsuit against Binance and founder Changpeng Zhao on May 29, 2025, ending one of the last remaining crypto enforcement actions by the regulator. The case, filed in June 2023, which accused the world's largest cryptocurrency exchange of illegally serving U.S. users, inflating trading volumes, commingling customer funds, and facilitating trading in crypto assets viewed as unregistered securities, was dismissed with prejudice, meaning the SEC cannot refile the same claims in the future.

The dismissal symbolically ends one of the most aggressive crypto crackdowns in U.S. history and aligns with the Trump administration's effort to position the U.S. as the crypto capital of the planet. The termination of the Binance case fits into the current SEC leadership's direction under Chair Paul Atkins to reverse enforcement actions taken by the previous SEC under Gary Gensler—the agency has already dropped cases against Coinbase, Kraken, Ripple, and Robinhood. The SEC was the last major regulator still pursuing Binance after the company paid a $4.3 billion settlement to the U.S. government in November 2023 for violating anti-money laundering and sanctions laws, as part of which Zhao pleaded guilty, stepped down as CEO, and served four months in federal prison while retaining much of his wealth.

The announcement of the case's termination came one week after Binance disclosed it would be taking a $2 billion investment from the Emirati state fund MGX entirely in USD1, a stablecoin newly launched by the Trump family's World Liberty Financial project. A Binance spokesperson told CNBC and The Guardian that the dismissal was a landmark moment, adding, We're deeply grateful to Chairman Paul Atkins and the Trump administration for recognizing that innovation can't thrive under regulation by enforcement. Critics, including Amanda Fischer, policy director at financial policy group Better Markets, told Banking Dive that the dismissal marks a new low in the SEC's already disgraceful recent history of surrendering in crypto cases, regardless of the merits and even when the agency is winning in court.

Sources: