The United States Department of Justice (DOJ) issued a memorandum on April 7, 2025, that immediately disbanded the National Cryptocurrency Enforcement Team (NCET), significantly reducing its capacity to pursue digital asset-related crimes. The four-page document titled "Ending Regulation by Prosecution," signed by Deputy Attorney General Todd Blanche, explicitly instructs prosecutors not to pursue cases against cryptocurrency exchanges, wallet providers, or other platforms unless clear criminal intent is involved. This decision aligns with President Trump's January executive order promising "regulatory clarity" and represents a significant policy shift from the previous administration's approach.

The memorandum clearly states: The Department of Justice is not a digital assets regulator, with Blanche sharply criticizing the previous administration's enforcement-led approach as ill conceived and poorly executed. The document directs prosecutors to focus exclusively on cases involving investor harm, fraud, terrorism financing, or other criminal activity, and to close ongoing investigations that do not align with the new priorities. The new policy explicitly prohibits the prosecution of regulatory violations—including unlicensed money transmitting, violations of the Bank Secrecy Act, unregistered securities offerings, and other violations of the Commodity Exchange Act—unless there is evidence that the defendant knew of the licensing or registration requirement at issue and violated such a requirement willfully.

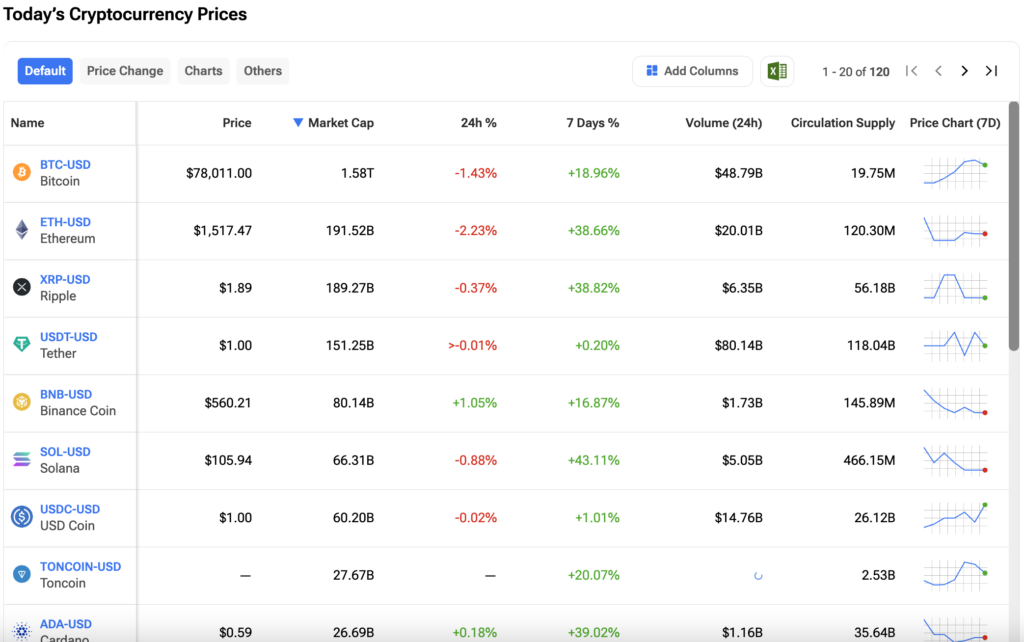

As a significant reorganization step in President Trump's second term, this decision could have serious implications for the cryptocurrency market and investor protection. Beyond the DOJ, the CFTC has also restructured its cryptocurrency-related task forces, with Acting CFTC Chair Caroline Pham recently consolidating enforcement into two units to increase efficiency. The NCET played a key role in major enforcement actions against cryptocurrency-related abuses in recent years, including cases against Tornado Cash developers and Mango Markets exploiter Avi Eisenberg. For investors, this change may mean fewer unexpected prosecutions, but could also create greater uncertainty, as enforcement will now depend on whether fraud or criminal intent is involved. The president and his family have also become enthusiastic cryptocurrency market participants: Trump launched his own meme coin, $TRUMP, shortly before his inauguration, which currently trades at $8.16, significantly down from its all-time high of $73.43.

Sources:

1.

2.

3.

4.

5.